What Is Term Life Insurance And How Does It Work?

Life is unpredictable, and while we can’t prevent the inevitable, we can prepare for it. One of the most straightforward and cost-effective ways to protect your loved ones financially is by securing term life insurance. Whether you’re a young parent, a homeowner, or someone planning for future responsibilities, understanding how term life insurance works can help you make sound financial decisions.

This article dives deep into the fundamentals of term life insurance, including its definition, how it operates, the types available, advantages and disadvantages, how it differs from other forms of life insurance, and answers to frequently asked questions.

Key Takeaways

- Term life insurance provides coverage for a fixed period at an affordable rate.

- It pays a tax-free death benefit if the insured dies during the term.

- Policies are customizable with options to convert, renew, or add riders.

- It is best suited for temporary needs like replacing income, paying off debt, or protecting a mortgage.

- Unlike permanent insurance, it does not build cash value.

- Review your policy regularly and adjust coverage as your life evolves.

What Is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a specific period or “term” — typically 10, 20, or 30 years. If the policyholder dies within the term, the insurance company pays a death benefit to the designated beneficiaries. However, if the policyholder outlives the term, no payout is made, and the coverage ends unless it is renewed or converted.

This form of life insurance is popular for its simplicity, affordability, and focus on temporary needs, making it an attractive option for individuals seeking maximum coverage for minimal cost.

How Does Term Life Insurance Work? – A Detailed Breakdown

Term life insurance is structured to provide pure life coverage for a set period of time, offering a financial safety net without the complexity of cash value or investment components. Below is a deeper dive into the six main components of how term life insurance works:

1. Selecting a Term: Aligning Coverage with Life’s Milestones

Choosing the correct term length is crucial to ensure you’re covered during the years when your financial responsibilities are highest.

Common Term Options:

- 10-year term: Best for short-term obligations or individuals nearing retirement.

- 15-year term: Suited for older buyers or covering smaller debts nearing payoff.

- 20-year term: Ideal for young parents wanting to protect children until they reach adulthood.

- 30-year term: Matches well with long-term financial commitments like mortgages or raising a young family.

How to Choose the Right Term:

Ask:

- When will your debts be paid off?

- When will your children become financially independent?

- Will your spouse be able to retire comfortably without your income?

Example:

A 35-year-old parent with a 30-year mortgage and two children under 5 might select a 30-year term to ensure the family is protected until the mortgage is paid and children are grown.

2. Choosing the Coverage Amount: Replacing Income and Covering Liabilities

The death benefit (coverage amount) is the financial cushion left for your beneficiaries. Choosing the right amount ensures that your family’s standard of living remains intact in your absence.

Factors to Consider:

- Your annual income and number of years your family will need it

- Debt obligations (mortgage, car loans, credit cards, personal loans)

- Future expenses (children’s college tuition, spouse’s retirement)

- Final expenses (funeral, medical bills)

- Existing savings and life insurance policies

Simple Rule of Thumb:

Multiply your annual income by 10 to 15 times. Adjust based on unique financial goals.

Advanced Tip: Use the DIME Formula:

- Debt

- Income replacement

- Mortgage

- Education

Example:

If you earn $80,000 annually and want to replace income for 15 years, the base coverage should be $1.2 million, not including debts or future education costs.

3. Paying Premiums: Affordable and Predictable

Premiums are the cost you pay to keep the policy active. Most term policies offer level premiums, meaning they stay the same throughout the term.

Payment Options:

- Monthly

- Quarterly

- Annually (often slightly cheaper in total)

Premium Costs Depend On:

- Age (younger = cheaper)

- Health (non-smokers save significantly)

- Gender (women generally pay less)

- Term length (longer terms = higher premiums)

- Coverage amount (more coverage = higher premiums)

Average Monthly Premium Examples:

| Age | $500,000 for 20 Years | Male (Non-Smoker) | Female (Non-Smoker) |

|---|---|---|---|

| 25 | $21 | $20 | $17 |

| 35 | $28 | $26 | $22 |

| 45 | $60 | $55 | $47 |

Tip: Lock in a lower premium sooner rather than later — term life gets more expensive each year you wait.

4. Medical Underwriting: Assessing Your Health Risk

Medical underwriting is how insurers evaluate the risk of insuring you. The healthier you are, the lower your premium.

Traditional Underwriting Includes:

- A health questionnaire

- Medical exam (blood test, urine sample, blood pressure, etc.)

- Review of medical records, family history, and lifestyle

No-Exam or Simplified Issue Policies:

- Skip the medical exam

- Rely on health questions and records

- Ideal for younger, healthier applicants or those needing quick approval

- Higher premiums than fully underwritten policies

Guaranteed Issue Policies:

- No questions or exam

- Often used for small, final expense policies

- Very high premiums and low coverage amounts

Tip: Even if you fear being declined, apply for multiple quotes. Health classifications vary by company — you might qualify for better rates than expected.

5. Death Benefit Payment: Tax-Free and Unrestricted Use

If the policyholder dies within the term, the insurer pays the agreed death benefit to the designated beneficiaries — tax-free in most cases.

How Beneficiaries Can Use the Money:

- Pay off mortgages or debts

- Cover daily living expenses

- Fund children’s education

- Continue a family business

- Invest for future income

Claim Process:

- File a death claim with the insurance company.

- Submit the death certificate.

- The insurer reviews and pays out, often within 30–60 days.

Tip: Keep your beneficiaries informed and ensure they know how to access policy documents and contact the insurance company.

6. Expiration or Renewal: Options at the End of the Term

When the policy term ends, you face three main options:

A. Let the Policy Expire

- If you no longer need coverage (e.g., kids are financially independent), you can let it lapse.

- No payout or refund is provided unless it has a return-of-premium rider.

B. Renew the Policy

- Many policies include a renewal clause, allowing yearly renewal.

- Premiums increase significantly with age — often doubling or tripling.

- Useful for short-term needs after the initial term ends.

C. Convert to Permanent Insurance

- Convertible term policies allow you to switch to a permanent policy (e.g., whole life) without medical exams.

- Must convert before a certain age or term milestone.

- Ideal if you want lifelong coverage or anticipate health changes.

Example:

A 45-year-old with a 20-year policy can convert it into whole life at age 60 without medical re-qualification, locking in lifelong coverage before major health issues arise.

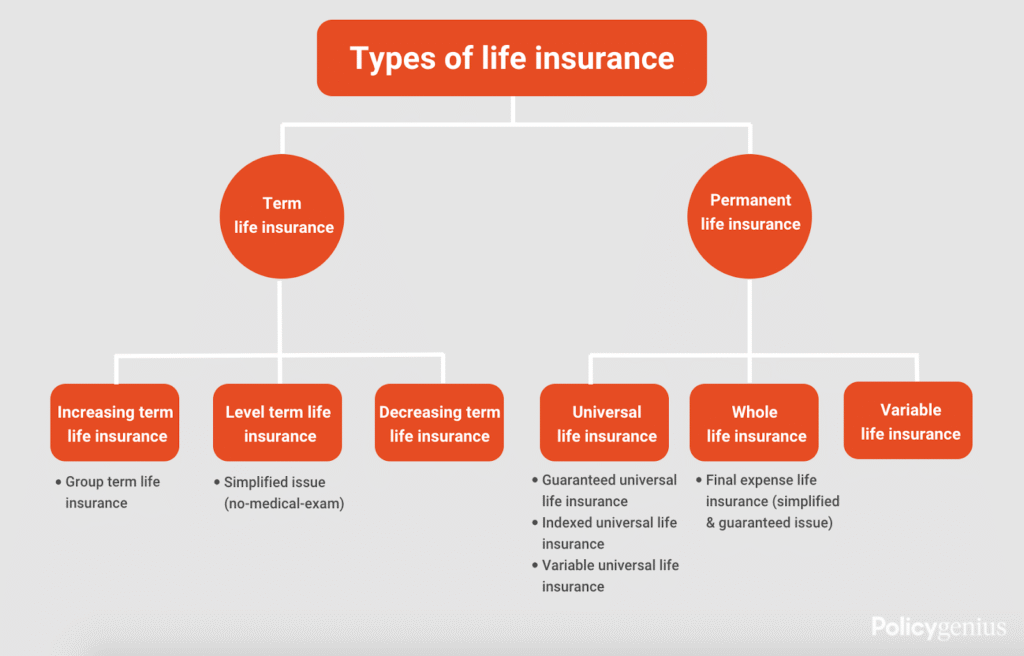

Types of Term Life Insurance – Detailed Overview

Term life insurance comes in various forms tailored to different financial goals, risk tolerances, and life circumstances. Choosing the right type can impact affordability, flexibility, and how well the policy fits your unique needs.

1. Level Term Life Insurance: Stability and Predictability

Definition:

Level term life insurance is the most straightforward and widely purchased type. Both the death benefit (coverage amount) and the premium payments stay the same — or “level” — for the entire term of the policy, which could be 10, 20, or 30 years.

How It Works:

If you buy a 20-year $500,000 level term policy, your beneficiaries receive $500,000 if you die anytime during those 20 years. Your premiums remain consistent, which makes budgeting easier.

Pros:

- Predictable premiums, no surprises over the term.

- Beneficiaries receive full death benefit regardless of when you pass within the term.

- Great for long-term financial planning, such as income replacement during child-rearing years or mortgage coverage.

Cons:

- Premiums may be higher initially compared to decreasing term because the death benefit stays fixed.

- If you outlive the term, no benefits or cash value remain.

Ideal For:

- Young families needing steady coverage through critical years.

- Individuals with long-term debts or financial responsibilities.

- People who want stable, affordable protection without fluctuations in cost.

Example:

John purchases a 30-year level term policy at age 35 with a $750,000 death benefit. His premiums stay the same until he turns 65, providing financial security throughout his working years.

2. Decreasing Term Life Insurance: Cost-Effective Debt Protection

Definition:

In decreasing term life insurance, the death benefit declines over time — typically on a predetermined schedule — while premiums usually remain fixed. This structure aligns with financial obligations that reduce over time, like a mortgage or loan.

How It Works:

Suppose you have a 20-year mortgage of $300,000. You could purchase a 20-year decreasing term policy starting with a $300,000 death benefit that decreases annually to zero as the mortgage is paid off.

Pros:

- Generally more affordable than level term for similar initial coverage.

- Matches declining liabilities, so you aren’t over-insured as your debt reduces.

- Helps keep premiums lower than a level term policy with the same starting benefit.

Cons:

- The death benefit shrinks, so your family receives less if you die later in the term.

- Does not provide coverage for non-debt-related expenses.

- Premiums do not decrease even though coverage does.

Ideal For:

People focused on covering specific debts rather than income replacement.

Homeowners wanting insurance to cover their mortgage balance only.

Borrowers with large, amortizing debts.

Benefits of Term Life Insurance – In-Depth Analysis

Term life insurance offers several compelling advantages that make it a popular choice for millions of people seeking straightforward, affordable protection. Understanding these benefits helps you decide if term life fits your financial goals and family’s needs.

1. Affordability: Protection Without Breaking the Bank

Why Term Life Is Cost-Effective:

Term life insurance is often the most affordable life insurance option on the market. This affordability stems from its simplicity: it provides pure protection without any investment or cash value component. You pay only for coverage during the term, not for savings or dividends.

Factors Contributing to Affordability:

- No cash value buildup — premiums are used purely for risk coverage.

- Level premiums locked in at policy inception.

- Younger, healthier applicants pay significantly lower premiums.

- Shorter term lengths typically cost less.

Example:

A 30-year-old non-smoker might pay just $20 to $25 per month for $500,000 coverage over 20 years, compared to hundreds monthly for a whole life policy.

Why This Matters:

For many families, especially young couples or individuals starting their careers, budget constraints make term life the only feasible way to get substantial coverage without sacrificing other financial priorities like saving or debt repayment.

Tip:

Lock in low premiums early to maximize savings over the policy’s duration.

2. Simplicity: Easy to Understand and Manage

Clear, Straightforward Structure:

Term life insurance is one of the simplest insurance products available, making it highly accessible.

How Simplicity Helps:

- You pay a fixed premium for a set number of years.

- If you die during the term, your beneficiaries receive the death benefit.

- If you outlive the term, the policy expires with no payout or cash value.

- No complex investment components or fees to track.

Why Simplicity Is Valuable:

This transparency helps policyholders know exactly what they’re buying, avoiding confusion and frustration often associated with permanent life insurance products.

Example:

Anna buys a 20-year term life policy. She pays $30 a month, and if she dies within 20 years, her family gets $400,000 tax-free. If she doesn’t, the coverage ends — no hidden conditions.

Tip:

Simplicity allows policyholders to focus on their protection needs rather than investment performance or cash value management.

3. Flexibility: Tailor Your Coverage to Life’s Needs

Customize Duration and Amount:

Term life insurance lets you choose the term length and death benefit to fit your financial situation and goals.

Why Flexibility Matters:

- Align coverage with specific financial responsibilities such as raising children, paying off a mortgage, or funding education.

- Adjust coverage to your budget, choosing affordable levels that still provide meaningful protection.

- Option to renew, convert, or purchase new policies as your life circumstances change.

Example:

A newlywed couple may choose a 30-year term with $1 million coverage, anticipating raising children and paying off their mortgage during this period. Later, if financial needs change, they can adjust their plans accordingly.

Real-Life Scenario:

John’s mortgage will be paid off in 15 years, so he purchases a 15-year term policy instead of 30 years, saving money while still covering the most critical period.

Tip:

Regularly review your coverage to ensure it continues to meet evolving financial goals.

4. Customizable Add-Ons (Riders): Enhancing Your Protection

Expand Coverage with Additional Riders:

Term life insurance policies can be enhanced with various riders — optional features that provide additional benefits or flexibility.

Here are some common riders:

a) Accelerated Death Benefit Rider

- Allows you to access a portion of the death benefit early if diagnosed with a terminal illness.

- Helps cover medical expenses or end-of-life care.

- Funds received reduce the final payout to beneficiaries.

b) Waiver of Premium Rider

- Waives premium payments if you become totally disabled and unable to work.

- Ensures your coverage continues without interruption during tough times.

c) Child or Spouse Rider

- Adds coverage for your spouse or children under the same policy.

- Usually inexpensive and provides protection for dependents at lower cost.

d) Return of Premium Rider

- Refunds all or part of the premiums paid if you outlive the policy term.

- Higher premiums but offers a savings-like feature.

- Great for those who want protection but dislike the idea of “losing” premium payments.

Benefits of Riders:

- Provide peace of mind for various contingencies.

- Tailor coverage to your specific family or health needs.

- Can often be added at application or during the policy term.

Example:

Lisa adds a waiver of premium rider to her term life policy. When she experiences a disability, her premiums are waived, and coverage continues without financial strain.

Why These Benefits Matter Together

When combined, the affordability, simplicity, flexibility, and customization of term life insurance create a compelling value proposition. It makes term life a go-to solution for many:

- Young families needing essential income replacement

- Individuals seeking temporary but significant financial protection

- Budget-conscious buyers wanting predictable, low-cost premiums

- Those who want the option to adjust or enhance their coverage over time

Drawbacks of Term Life Insurance

1. No Cash Value

Unlike whole life insurance, term policies do not accumulate cash value or investment returns.

2. Temporary Coverage

If you outlive the term, you won’t get any return unless you purchased a “return of premium” rider.

3. Higher Cost Upon Renewal

If you choose to renew after your initial term, premiums can become prohibitively expensive due to increased age or health issues.

Term Life Insurance vs. Whole Life Insurance

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (e.g., 20 years) | Lifelong |

| Cost | Lower premiums | Higher premiums |

| Cash Value | No | Yes |

| Simplicity | Very simple | More complex |

| Purpose | Income replacement | Wealth building, estate planning |

| Flexibility | High for short-term needs | Lower, but long-term benefits |

Who Should Consider Term Life Insurance?

Term life insurance is a versatile product that serves a wide range of people and financial situations. While it’s not one-size-fits-all, certain groups especially benefit from its affordability, flexibility, and simplicity.

1. Young Families Needing Income Replacement

Why Term Life Fits:

Young families often rely heavily on one or both parents’ incomes to cover daily living expenses, childcare, education, and mortgage payments. Losing a breadwinner without life insurance could lead to financial hardship or forced lifestyle changes.

How Term Life Helps:

- Provides a financial safety net to replace lost income.

- Supports ongoing expenses until children become financially independent.

- Affordable premiums allow families to secure substantial coverage even on a limited budget.

Example:

Jessica and Mark, both in their early 30s with two young children, purchase a 30-year term life policy totaling $1 million. If one of them dies, the payout helps cover childcare, college savings, and mortgage payments, keeping the family financially stable.

Key Point:

Term life protects the family during the years they need it most—while children are minors and financially dependent.

2. Homeowners with Mortgages

Why Term Life Fits:

Mortgage debt is often the largest financial obligation for homeowners. If the borrower dies prematurely, the surviving family members might struggle to keep up with payments, risking foreclosure and loss of the family home.

How Term Life Helps:

- Covers outstanding mortgage balance.

- Provides peace of mind knowing the home is protected.

- Decreasing term life insurance can be particularly effective here, as the death benefit declines in line with mortgage payoff.

Example:

David purchases a 20-year decreasing term policy matching his mortgage balance of $350,000. Over time, as he pays down the mortgage, the coverage reduces correspondingly, saving on premium costs while protecting his family’s home.

Key Point:

Term life insurance ensures the family retains housing stability in case of the borrower’s untimely death.

3. Business Owners with Partners or Key Employees

Why Term Life Fits:

Business owners often face financial risks if a key person, such as a partner or critical employee, dies unexpectedly. Term life insurance can safeguard the business against such losses.

How Term Life Helps:

- Provides funds to buy out a deceased partner’s share.

- Covers costs related to hiring and training replacements.

- Maintains business continuity and financial stability.

Example:

A law firm owner takes out term life insurance policies on both partners. If one dies, the other receives funds to buy out the deceased partner’s stake, preventing conflict and preserving business operations.

Key Point:

Term life is a cost-effective way for business owners to protect against the financial impact of losing essential personnel.

4. Single Parents with Dependents

Why Term Life Fits:

Single parents bear the entire financial responsibility for raising children alone. Term life insurance provides crucial protection to ensure children’s needs are met if the parent passes away.

How Term Life Helps:

- Replaces lost income to cover living costs and education.

- Provides funds to hire caregivers or tutors if needed.

- Offers emotional peace of mind knowing dependents are financially secured.

Example:

Maria, a single mother of two, purchases a 25-year term life policy with a $500,000 death benefit. This ensures her children’s future expenses, including college, are covered even if she’s no longer there.

Key Point:

Term life insurance helps single parents maintain their children’s quality of life regardless of unforeseen events.

5. Individuals on a Budget Wanting High Coverage at Low Cost

Why Term Life Fits:

Not everyone has the budget for permanent life insurance, which tends to be expensive. Term life allows individuals to secure large death benefits for relatively low premiums.

How Term Life Helps:

- Maximizes coverage with minimum premiums.

- Provides essential protection without financial strain.

- Ideal for those prioritizing coverage over investment features.

Example:

Tom, a 28-year-old healthy non-smoker, opts for a 20-year $1 million term life policy. For under $30 a month, he gains peace of mind knowing his family is protected without compromising his budget.

Key Point:

Term life democratizes life insurance by offering affordable access to substantial coverage.

6. People Planning to Convert to Whole Life Later

Why Term Life Fits:

Some buyers want temporary, affordable coverage now but anticipate needing permanent coverage later in life. Convertible term policies allow switching to whole or universal life insurance without additional medical exams.

How Term Life Helps:

- Provides initial low-cost coverage.

- Locks in insurability for future conversion.

- Offers flexibility as financial circumstances evolve.

Example:

Emily buys a 15-year convertible term policy at age 35. At 50, she converts it to a whole life policy when her income and assets have grown, securing lifelong protection without new health assessments.

Key Point:

Convertible term life policies combine affordability today with permanence tomorrow.

Additional Considerations

While term life insurance suits many, it may not be ideal for those needing lifelong coverage or a cash value component for savings or estate planning. Assess your goals, financial obligations, and health status to decide if term life aligns with your needs.

How to Buy Term Life Insurance: A Step-by-Step Guide

Purchasing term life insurance is a significant financial decision that involves understanding your needs, evaluating options, and selecting the right policy. Here’s a detailed breakdown of the buying process to help you secure the best protection for yourself and your loved ones.

1. Assess Your Needs: Determine the Right Coverage

Before shopping for a policy, it’s crucial to understand how much coverage you require and for how long. This step forms the foundation of your purchase decision.

How to Assess Your Needs:

- Use Online Calculators: Many insurance websites offer life insurance calculators that factor in income, debts, dependents, and future expenses to estimate a recommended coverage amount.

- Consider Your Financial Obligations: Calculate debts (mortgage, loans), daily living expenses, childcare, education costs, and future financial goals.

- Factor in Existing Assets: Subtract savings, retirement funds, and existing life insurance coverage to determine the gap you need to fill.

- Consult a Financial Advisor: For a personalized analysis, a certified financial planner can provide expert guidance based on your unique financial situation.

Example:

Sarah is a 35-year-old mother with a $300,000 mortgage, two young children, and $50,000 in savings. A calculator estimates she needs $750,000 in coverage for 20 years to cover debts, living expenses, and college funding.

Tip: Don’t just guess—accurate assessment ensures you buy enough coverage without overpaying.

2. Compare Quotes: Shop Around for the Best Policy

Term life insurance premiums and features can vary significantly between insurers. Comparing multiple quotes ensures you get competitive pricing and suitable coverage.

How to Compare Quotes:

- Use Aggregator Websites: Platforms like Policygenius, NerdWallet, or Insure.com let you input your details once and receive multiple quotes quickly.

- Check Company Ratings: Look for insurers with strong financial ratings from A.M. Best, Moody’s, or Standard & Poor’s to ensure reliability.

- Review Policy Features: Beyond price, compare term lengths, renewal options, conversion rights, and available riders.

- Consider Customer Service: Read reviews to gauge claims handling, customer support, and ease of application.

Example:

John obtains quotes from three insurers for a 20-year, $500,000 term policy. The premiums range from $22 to $35 monthly. He also notes one insurer offers a waiver of premium rider at no extra cost.

Tip: Don’t choose solely on price—value, service, and flexibility are equally important.

3. Apply: Complete the Application and Medical Exam (if required)

Once you select an insurer, you start the formal application process.

What to Expect:

- Provide Personal Information: Name, age, address, occupation, income, lifestyle habits, and medical history.

- Medical Exam: Most insurers require a paramedical exam—measuring height, weight, blood pressure, and collecting blood/urine samples.

- Health Questionnaire: Questions about current health, family medical history, smoking status, and risky activities.

- No-Exam Policies: Available for some term life policies, especially smaller coverage amounts, though these generally have higher premiums.

Tips for a Smooth Application:

- Be honest and accurate; misstatements can lead to denial of claims.

- Prepare by gathering medical records and recent health info.

- Schedule the medical exam promptly to avoid delays.

4. Underwriting: Insurer Assesses Your Risk

After receiving your application and medical results, the insurer evaluates your risk level.

Underwriting Process:

- Risk Assessment: Review medical history, lifestyle, occupation, family history, and exam results.

- Risk Classes: Insurers assign you a risk class (Preferred Plus, Preferred, Standard, etc.) that influences premiums.

- Additional Info: In some cases, the insurer may request more information or a specialist report.

Timeline:

- Typically takes 2-6 weeks, but some companies offer accelerated or instant underwriting for qualified applicants.

Tip: The healthier and younger you are, the better your risk class and premiums.

5. Policy Issue: Approval and Activation

If underwriting is successful, the insurer issues the policy.

What Happens Next:

- Policy Delivery: You receive the official policy documents detailing coverage, premiums, terms, and conditions.

- Review Carefully: Verify all details for accuracy and understand your rights.

- Make First Payment: Pay the initial premium to activate coverage.

- Policy Starts: Coverage becomes effective on the start date specified in the contract.

Also Read:- What’s the Best Car Insurance for Your Needs?

Conclusion

Term life insurance is a powerful tool for financial protection, offering a low-cost way to ensure your family or dependents are taken care of in the event of your untimely death. While it doesn’t build cash value or provide lifelong coverage, it delivers peace of mind and financial security when it’s needed most.

Whether you’re just starting a family, buying a home, or managing a business, term life insurance provides a flexible, affordable safety net. It’s important to assess your personal needs, shop around, and understand the terms before choosing a policy. A little preparation today can make a world of difference for your loved ones tomorrow.

FAQs

1. What happens if I outlive my term life insurance policy?

Your coverage simply expires, and you stop paying premiums. No death benefit is paid. Some policies allow renewal or conversion.

2. Can I renew a term life insurance policy after it expires?

Yes, but your premiums will likely increase based on your age and health. Not all policies are renewable, so check the terms.

3. Is a medical exam required to get term life insurance?

Not always. Some insurers offer no-exam policies, but these may have higher premiums and lower coverage limits.

4. How much term life insurance do I need?

A common rule is 10 to 15 times your annual income, but individual needs vary. Consider debts, dependents, and long-term goals.

5. What’s the difference between term life and accidental death insurance?

Term life covers death from any cause (except exclusions like suicide in the first year), while accidental death insurance only pays for deaths due to accidents.

6. Can I cancel my term life insurance anytime?

Yes. You can stop paying premiums or formally cancel the policy. There are no penalties, but you won’t get a refund unless you had a return-of-premium rider.

7. Are term life insurance payouts taxable?

Generally, no. Death benefits are usually tax-free for beneficiaries. Exceptions may apply for large estates or certain business policies.