What’s The Best Car Insurance For Your Needs?

Car insurance is an essential aspect of vehicle ownership, providing financial protection in case of accidents, theft, or other unforeseen events. However, with countless insurance providers, policies, coverage options, and pricing strategies, finding the best car insurance tailored to your needs can be a daunting task. This article aims to simplify that process by helping you understand how car insurance works, the types of coverage available, what to look for in a policy, and how to select the best insurance for your unique situation.

Key Takeaways

- Car insurance is vital for legal compliance and financial protection.

- Know the types of coverage and choose based on your needs and risks.

- Compare insurers by price, reputation, and customer service.

- Use discounts and smart strategies to save money.

- Avoid common mistakes like underinsuring or neglecting to update your policy.

- Regularly review your insurance to ensure optimal coverage.

Understanding Car Insurance Basics

Car insurance serves as a financial safety net that helps protect drivers from unexpected and potentially significant costs resulting from accidents, theft, or other vehicle-related incidents. At its core, car insurance is a legally binding agreement between the policyholder (you) and an insurance company. In this agreement, you agree to pay a regular fee known as a premium—typically monthly, quarterly, or annually—in return for a promise from the insurer to cover certain types of financial loss as outlined in your policy. These losses may include damages to your vehicle, injuries to yourself or others, property damage, and even legal costs depending on the level and type of coverage you choose. The policy also specifies a deductible, which is the amount you must pay out-of-pocket before your insurance kicks in to cover a claim. Insurance coverage is often categorized into mandatory and optional types, with liability coverage being legally required in most regions. Optional coverages, such as collision or comprehensive insurance, provide added protection and can be tailored to suit your personal needs and financial situation. Understanding how car insurance functions—and the specific terms and conditions in your policy—is essential for making informed decisions, ensuring you are adequately covered, and avoiding surprises when filing a claim.

Why is Car Insurance Important? (Expanded)

Car insurance plays a critical role in modern life, not just as a legal formality but as a crucial layer of financial and emotional protection. Let’s explore the deeper importance of car insurance across various dimensions:

1. Legal Requirement

In most countries and states, having at least a minimum amount of car insurance is a legal obligation for all drivers. This requirement exists to ensure that every motorist can be held financially responsible for damages or injuries they may cause while driving. Driving without insurance can lead to severe consequences such as fines, license suspension, vehicle impoundment, or even imprisonment in some jurisdictions. By mandating insurance, governments aim to protect all road users—ensuring that victims of car accidents are not left without recourse simply because the at-fault driver is unable to pay.

2. Financial Protection

One of the primary functions of car insurance is to shield you from the high costs that can arise after an accident. Consider the potential expenses: repairing or replacing your car, covering the cost of damage to another vehicle or property, and paying medical bills for injuries suffered by you, your passengers, or others involved in the accident. These costs can easily run into the tens or hundreds of thousands of dollars. Without insurance, you would be personally responsible for covering these expenses, which could lead to financial ruin or long-term debt. Insurance acts as a financial buffer, allowing you to recover and rebuild without bearing the full weight of those costs.

3. Peace of Mind

Accidents can happen at any time—even to the most cautious drivers. Car insurance provides peace of mind by reducing the stress and anxiety associated with the unpredictability of driving. Knowing that you’re financially protected if the unexpected happens gives you the confidence to drive without fear. Whether you’re commuting to work, going on a road trip, or simply running errands, the assurance that you won’t be financially devastated by an accident brings a level of comfort that is invaluable.

4. Protects Others

Car insurance isn’t just about you—it also safeguards the well-being of others on the road. If you’re at fault in an accident, your liability coverage ensures that those you’ve harmed—whether by injuring them or damaging their property—receive the compensation they deserve. Without insurance, victims would have to sue you personally to recover their losses, which could be a long and painful legal process with no guarantee of repayment. Insurance ensures that people receive help promptly, and it supports social responsibility by making sure everyone contributes to a safer driving environment.

5. Lender and Lease Requirements

If you’re financing or leasing a car, your lender or leasing company will almost always require you to carry comprehensive and collision coverage. These additional protections ensure that their financial interest in the vehicle is protected in the event of damage or theft. Without the appropriate coverage, you could be in breach of your loan or lease agreement, leading to penalties or repossession.

6. Legal Defense and Liability

In more severe accidents, legal claims or lawsuits may arise. Quality car insurance often includes coverage for legal defense costs, which can be incredibly expensive. If you’re sued, your insurer typically provides legal representation and helps manage settlement negotiations. This aspect of insurance is particularly important in serious or high-liability cases.

How Does Car Insurance Work?

- Premium: The amount you pay periodically (monthly, quarterly, yearly) for your policy.

- Deductible: The out-of-pocket amount you pay before insurance covers the rest.

- Coverage Limits: The maximum amount an insurer will pay under your policy for specific damages or claims.

Types of Car Insurance Coverage

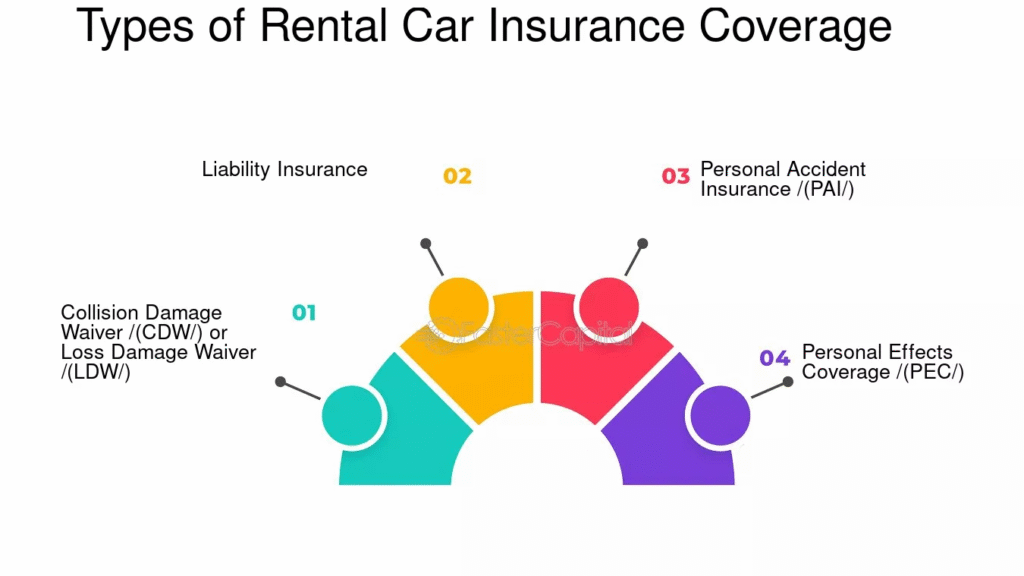

There are various types of coverage you can include in your car insurance policy. Understanding them helps you select the right combination for your situation.

Liability Insurance

Covers damages you cause to others, including bodily injury and property damage. It’s usually mandatory.

- Bodily Injury Liability: Covers medical expenses and lost wages of others injured in an accident you caused.

- Property Damage Liability: Covers repair or replacement of other people’s property damaged in an accident you caused.

Collision Coverage

Pays for damages to your vehicle resulting from a collision with another car or object, regardless of fault.

Comprehensive Coverage

Protects against non-collision damages such as theft, vandalism, fire, natural disasters, or hitting an animal.

Personal Injury Protection (PIP)

Covers medical expenses and sometimes lost wages and other damages for you and your passengers, regardless of fault.

Uninsured/Underinsured Motorist Coverage

Protects you if you’re hit by a driver who has no insurance or insufficient coverage.

Medical Payments Coverage (MedPay)

Pays for medical expenses after an accident regardless of fault.

Gap Insurance

Covers the difference between what you owe on a car loan and the car’s actual cash value if the car is totaled.

Factors Affecting Car Insurance Rates

Insurance premiums vary widely based on multiple factors:

Personal Factors

- Age: Younger and elderly drivers often face higher premiums.

- Gender: Statistically, some genders have higher accident rates.

- Driving Record: A clean record means lower rates; accidents or tickets increase premiums.

- Location: Urban areas typically have higher premiums due to traffic and theft risk.

- Credit Score: In many places, insurers use credit-based insurance scores to determine risk.

Vehicle Factors

- Make and Model: Expensive or high-performance cars cost more to insure.

- Age of Vehicle: Newer cars cost more to insure but may have better safety features.

- Usage: How often and how far you drive impacts premiums.

Coverage Choices

- Coverage Limits: Higher limits mean higher premiums.

- Deductibles: Higher deductibles reduce premiums but increase your out-of-pocket costs.

- Add-Ons: Extras like roadside assistance or rental reimbursement add to cost.

How to Determine Your Car Insurance Needs: A Thorough Guide

Selecting the right car insurance policy isn’t a one-size-fits-all decision. It requires a careful assessment of your individual circumstances, risks, financial capacity, and legal obligations. By understanding these factors, you can choose coverage that not only meets legal requirements but also protects you adequately without overpaying. Here’s a detailed breakdown to help you determine your optimal car insurance needs:

1. Assess Your Risk

Your risk profile is one of the most critical factors in determining the type and amount of car insurance you should carry.

- Driving Environment: If you frequently drive in high-traffic urban areas, the likelihood of accidents increases. Likewise, living or parking your car in a high-crime neighborhood may expose your vehicle to theft or vandalism. In such cases, opting for more comprehensive coverage makes sense.

- Driving Frequency and Distance: The amount you drive also affects your risk. Long commutes, frequent road trips, or regular driving for work increase your exposure to accidents or breakdowns. Conversely, if you drive only occasionally or short distances, you might qualify for low-mileage discounts or consider less extensive coverage.

- Driving History: Your past driving record is a strong indicator of risk. A history of accidents, traffic violations, or DUIs generally means higher premiums but also signals the need for adequate coverage to protect against potential liabilities. Conversely, a clean driving record could qualify you for safer driver discounts and allow you to tailor your coverage more cost-effectively.

Understanding your risk helps you balance premium costs with the level of protection you need, ensuring you’re not underinsured in high-risk situations or overpaying in low-risk ones.

2. Understand Your Financial Situation

Your financial health directly influences how much insurance you should carry and what types of coverage make sense.

- Premium Affordability: Evaluate how much you can comfortably afford to pay in monthly or annual premiums without straining your budget. Remember that the cheapest policy isn’t always the best, but you also want to avoid policies with premiums so high they become unsustainable.

- Deductible Capacity: Higher deductibles lower your premium costs but require more out-of-pocket spending in the event of a claim. Be honest about your ability to cover this expense without hardship. If an accident occurs, can you afford the deductible, or will it cause financial strain?

- Savings and Assets: If you have significant savings, investments, or assets, you may want higher liability limits to protect your wealth from lawsuits or claims following an accident. Without sufficient insurance, your personal assets could be at risk if you’re found legally responsible for damages or injuries.

By understanding your finances, you can choose insurance that balances premium costs with out-of-pocket risk, protecting your long-term financial stability.

3. Consider Your Vehicle

The characteristics and status of your car play a key role in determining the necessary coverage.

- Age and Value of the Car: Newer or expensive vehicles typically warrant more comprehensive and collision coverage to protect against repair or replacement costs. Older cars with lower market value may not justify paying high premiums for comprehensive or collision coverage because the cost of insurance might exceed the vehicle’s worth.

- Financing or Leasing Requirements: If you have a loan or lease on your vehicle, the lender or leasing company usually mandates full coverage insurance (liability, collision, and comprehensive) to protect their financial interest. This means you’ll need a policy that meets or exceeds these requirements until you fully own the vehicle.

- Usage of the Vehicle: If your car is a primary mode of transportation, you might want broader coverage. However, if it’s a secondary vehicle or used infrequently, you could consider minimal or usage-based coverage options.

Assessing your vehicle’s condition, value, and financing status helps you avoid paying for unnecessary coverage or risking insufficient protection.

4. Legal Requirements

Every state or country sets minimum insurance coverage requirements to legally operate a vehicle. These usually include:

- Liability Coverage: Covers damages or injuries you cause to others in an accident. Almost universally required.

- Personal Injury Protection (PIP) or Medical Payments: Covers medical expenses for you and your passengers.

- Uninsured/Underinsured Motorist Coverage: Protects you if another driver causes an accident and lacks adequate insurance.

It’s important to comply with these minimums to avoid legal penalties like fines, license suspension, or vehicle impoundment. However, minimum coverage may not fully protect you financially, so consider higher limits or additional coverages.

5. Coverage Goals

Beyond legal minimums, define your personal goals for protection:

- Full Protection: If you want peace of mind that all potential risks are covered, including damage to your own car, injuries, theft, natural disasters, and liability, consider comprehensive, collision, and high-limit liability coverage. This approach is especially recommended if you rely heavily on your vehicle or own a valuable car.

- Minimum Required: If your budget is tight or your vehicle’s value is low, you might opt for the minimum legal coverage to meet the law but accept greater personal financial risk. This can be reasonable if you have adequate savings and don’t rely heavily on the vehicle.

- Medical and Liability Protection: If protecting yourself and others from injury-related expenses is a priority, ensure your policy includes sufficient personal injury protection or medical payments coverage, along with robust liability limits.

- Additional Protections: Consider add-ons like roadside assistance, rental car reimbursement, gap insurance (to cover the difference between what you owe on a loan and the car’s value), or custom equipment coverage depending on your unique needs.

Putting It All Together:

Determining your car insurance needs is a balancing act between risk, finances, legal compliance, and personal preferences. Here’s a step-by-step approach to streamline the process:

- Evaluate Your Driving Environment and History: Identify risk factors.

- Assess Your Financial Ability: Determine what premiums and deductibles you can manage.

- Analyze Your Vehicle’s Value and Loan Status: Choose coverage accordingly.

- Know Your Legal Requirements: Ensure at least minimum compliance.

- Define Your Coverage Goals: Decide between minimal and comprehensive protection.

Comparing Car Insurance Providers: A Detailed Guide

Choosing the right car insurance provider is as important as selecting the right coverage. Not all insurance companies operate with the same level of service, reliability, or value. Here are the critical factors to consider when comparing insurers:

1. Reputation and Customer Service

A company’s reputation reflects how it treats customers, handles claims, and resolves disputes. It’s vital to look beyond just price. Resources like J.D. Power’s Customer Satisfaction Ratings, Consumer Reports, and the Better Business Bureau (BBB) provide valuable insights based on customer feedback and complaint ratios. Positive reviews often highlight timely claim settlements, responsive customer service, and transparent communication.

Poor customer service or delayed claims processing can turn a stressful situation into a nightmare. Check if the insurer has a 24/7 claims hotline and whether it provides digital tools like mobile apps or online claim filing to streamline the process.

2. Financial Stability

Insurance is a long-term financial relationship. You want to make sure the insurer can pay claims even during widespread disasters or economic downturns. Agencies like A.M. Best, Standard & Poor’s, and Moody’s provide ratings on the financial health of insurance companies. A high rating indicates the company is financially sound and capable of meeting its obligations.

Choosing a financially unstable insurer can lead to problems if the company faces bankruptcy or severe financial strain, leaving you without coverage or payout when you need it most.

3. Discounts and Benefits

Many insurers offer a range of discounts that can significantly reduce your premiums. These may include:

- Safe Driver Discounts: For a clean driving record.

- Multi-Policy Discounts: Bundling auto insurance with homeowners or renters insurance.

- Low Mileage Discounts: For drivers who use their cars less frequently.

- Good Student Discounts: For young drivers maintaining good academic performance.

- Military and Senior Discounts: Special rates for military personnel and senior citizens.

- Vehicle Safety Feature Discounts: For cars equipped with airbags, anti-lock brakes, or anti-theft devices.

When comparing providers, consider the availability and eligibility criteria for these discounts, as they can affect the overall value of your policy.

4. Claims Process

How an insurer handles claims is crucial. The claims process should be efficient, transparent, and fair. Delays or disputes can cause financial and emotional stress. Look for companies known for:

- Quick claim processing times.

- Fair claim settlements aligned with policy terms.

- Ease of filing claims through apps or online portals.

- Responsive and supportive customer service throughout the claim lifecycle.

You can often find claims satisfaction ratings in consumer reports or testimonials. Some insurers also provide direct repair shop partnerships, which can expedite repairs and reduce hassle.

5. Policy Options and Flexibility

Your insurance needs might evolve over time, so it’s beneficial to choose an insurer that offers flexible policies and the ability to add optional coverages, called riders or endorsements. These might include:

- Roadside assistance.

- Rental car reimbursement.

- Gap insurance.

- Custom parts and equipment coverage.

A company that allows customization helps you tailor coverage precisely to your risk profile and budget, avoiding paying for unnecessary extras.

6. Price Comparison

While price shouldn’t be the sole deciding factor, it’s still very important. Obtain multiple quotes from different companies to ensure you get competitive rates. Online quote tools can make this easier, but speaking directly with an agent can sometimes uncover discounts not available online.

Remember, the cheapest policy might not provide sufficient coverage or the best service. Weigh price alongside other factors for the best value.

Tips for Saving on Car Insurance: In-Depth Strategies

Saving money on car insurance doesn’t mean sacrificing coverage quality. Here are effective ways to reduce your premiums:

1. Shop Around Annually

Insurance markets are dynamic—premiums fluctuate due to competition, changes in your personal situation, or broader market factors. By comparing quotes every year, you can take advantage of new discounts or switch providers if better offers arise. Even a few minutes spent gathering quotes can save you hundreds annually.

2. Increase Your Deductible

Your deductible is the amount you pay out of pocket before your insurer covers the rest of a claim. Opting for a higher deductible generally reduces your premium because you’re assuming more risk. However, ensure you can comfortably afford the deductible if an accident occurs. For example, increasing your deductible from $250 to $1,000 can lower your premium significantly but requires you to cover more initially.

3. Bundle Policies

Most insurers offer discounts if you purchase multiple policies with them, such as combining your auto, home, renters, or even life insurance. Bundling can lead to savings of 10-25% or more on your auto premiums. Plus, managing all your policies through one provider simplifies billing and customer service.

4. Maintain a Good Credit Score

In many states, insurers use credit scores as a factor to calculate premiums because statistical data show a correlation between credit history and risk. Improving your credit by paying bills on time, reducing debt, and correcting errors on your credit report can lower your insurance rates.

5. Take Defensive Driving Courses

Completing an approved defensive driving course demonstrates your commitment to safe driving, which insurers reward with discounts. These courses often teach techniques that reduce the likelihood of accidents, further justifying the reduced premium.

6. Drive Less

If you drive fewer miles than average, many insurers offer low-mileage discounts. Driving less reduces your exposure to risk. Some companies use telematics or usage-based insurance programs that monitor your actual driving habits, rewarding safe and infrequent driving with lower premiums.

7. Avoid Claims for Minor Incidents

While it might be tempting to file claims for every small fender-bender, doing so can increase your premiums. Paying out-of-pocket for minor repairs helps maintain a clean claims history, which insurers see as a sign of a low-risk driver. Frequent claims often signal higher risk, leading to premium hikes or even non-renewal.

Common Mistakes to Avoid When Choosing Car Insurance

- Buying minimum coverage without considering full risks.

- Not reviewing or updating your policy regularly.

- Ignoring the insurer’s reputation and claim service.

- Over-insuring an older car that isn’t worth the cost.

- Focusing solely on price without understanding coverage.

Also Read:-What Does a Vehicle Insurance Policy Cover and What Doesn’t It?

Conclusion

Selecting the best car insurance for your needs involves a balance between adequate coverage, cost, and peace of mind. Understanding the types of coverage, factors influencing premiums, and how to assess your unique situation will empower you to make an informed choice. Remember that the cheapest policy may not always be the best. Prioritize insurance companies with good reputations, fair claims processes, and the coverage that fits your lifestyle and financial situation. Regularly reviewing and updating your policy ensures it remains aligned with your evolving needs.

FAQs

1: Is it better to buy car insurance from a big company or a smaller one?

Both have pros and cons. Big companies often offer more discounts and technology, while smaller companies may provide personalized service. Research and compare.

2: Can I insure a car I don’t own?

Usually, insurance covers the car, not the driver, but the owner must typically consent. Check with your insurer.

3: What happens if I drive without insurance?

Penalties vary by state and country but can include fines, license suspension, and legal liability for accidents.

4: Does my insurance cover rental cars?

Some policies include rental reimbursement; otherwise, you may need a separate rental car insurance policy.

5: How can I lower my car insurance premium if I have a bad driving record?

Taking defensive driving courses, increasing your deductible, and shopping around can help.

6: Is comprehensive coverage worth it for an old car?

It depends on the car’s value. Sometimes the cost of comprehensive outweighs the payout.

7: Can I cancel my car insurance anytime?

Yes, but some insurers may charge cancellation fees. Make sure you have new coverage lined up to avoid gaps.